The Department of Posts has launched a PLI Post Life Insurance Plan called Endowment Assurance Santosh Plan, under this scheme plan the person is given an assurance to the extent of the Sum Assured and accrued bonus till the pre-determined age of maturity, maturity ages are 35,40,45,50,55,58,60 years.

In case of an unexpected death of the person, the nominee or legal heir will be paid the full Sum Assured together with the accrued bonus.

Santosh Endowment Assurance

Endowment Assurance Santosh Insurance Plan Review

The minimum age entry under this scheme is 19 years and the maximum is 55 years, with minimum Sum Assured is Rs 20,000 and maximum Sum Assured is Rs 50 lakhs.

You can also avail loan facility under this Santosh Endowment Assurance Insurance once 3 years is completed.

Another good thing is you can also surrender the policy only after the completion of three years.

Note: The last declared Bonus value of Santosh Endowment Assurance is Rs 58 per ₹ 1000 sum assured per year.

Endowment Assurance Important Note

The policy is not eligible for the bonus if surrendered or assigned for a loan before completion of 5 years.

India Post’s Postal Life Insurance “Insuring Lives, Ensuring Future” – PLI is the highest return (with bonus) and lowest premium charged for any product in the Indian Life Insurance schemes market.

Endowment Assurance Calculator

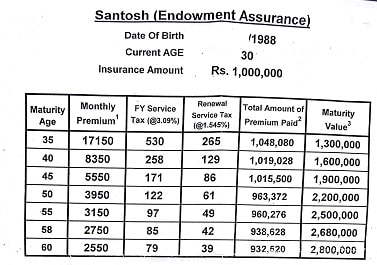

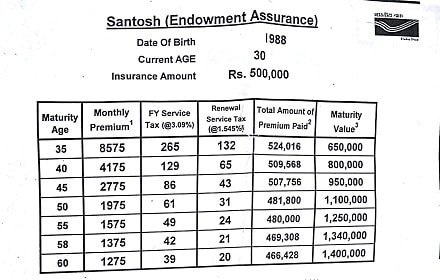

Below are the charts for a 30 Years Old with an Insurance amount of Rs 5,00,000 and Rs 10,00,000.

Santosh Endowment Assurance plan will have a fixed Maturity age.

Santosh Endowment Assurance Calculator

Above is an example for a 30-year-old who takes Insurance amount of Rs 10,00,000 with 50 Years Maturity Age then he needs to pay Monthly Rs 3950 with FY Service Tax Rs 122 amounting to Rs 4072 will get Rs 22,00,000 22 Lakhs at the end of 50 years, the total amount he pays is Rs 9,63,372. Check below examples for Rs 5,00,000 Plan.