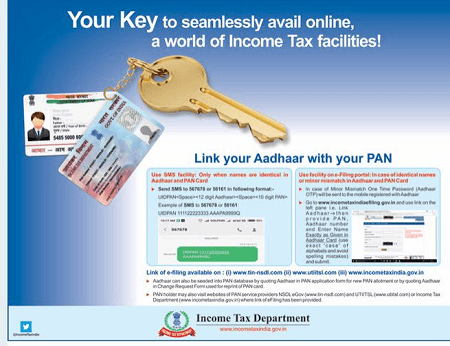

According to Income Tax Department now it is mandatory to link PAN Card with Aadhaar card and last date for this is 31st March 2022 else Rs 10,000 penalty will be levied. Now you can link PAN With Aadhaar by sending an SMS to 567678 or 56161. Aadhaar has been made mandatory for applying for permanent account number with effect from July 1, 2017. While Aadhaar is issued by the UIDAI to a resident of India, PAN is a ten-digit alphanumeric number issued in the form of a laminated card by the I-T department to any person, firm or entity.

Link PAN With Aadhaar

Using your mobile number just send a sms to 567678 or 56161 using below keyword format.

Link PAN With Aadhaar By SMS

Here is how you can use the SMS facility to link Aadhaar with PAN

567678

Send SMS to 567678 or 56161 in following format:

UIDPAN 12DigitAadhaar 10digitPAN

Example: UIDPAN 123456789102 ANRPC55443

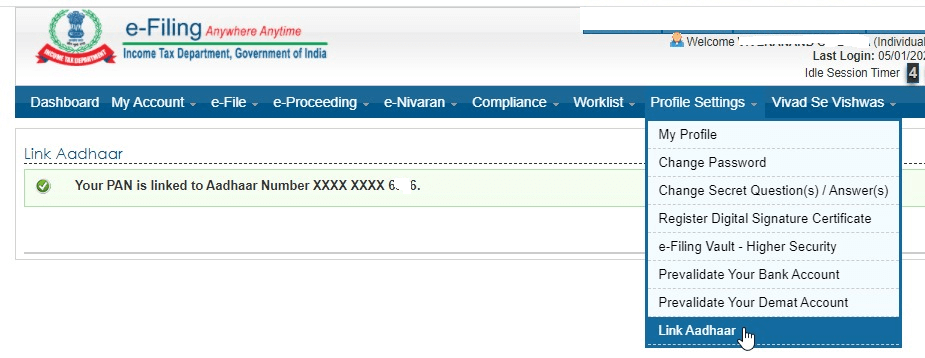

How to Check Whether My PAN is Linked with Aadhaar

If you want to check or Verify Whether your PAN card is Linked with Aadhaar Number then just follow below steps.

1. Visit https://www.incometaxindiaefiling.gov.in/home

2. Go to Profile Settings and Link Aadhaar Option.

3. Now you can see whether you have linked PAN with Aadhaar correctly or not, see below image.

Your key to seamlessly avail online,

a world of Income Tax facilities!

Link your Aadhaar with your PAN; pic.twitter.com/zpOAuZidoN— Income Tax India (@IncomeTaxIndia) May 31, 2017

Alternatively you can also link your PAN Card With Aadhaar on IncomeTax Website also just follow below steps

1. Go to this link https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html and link your Aadhaar with PAN

2. Upon submitting you get reference code and status of it.

To update your PAN details please visit NSDL portal

https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

To Update Aadhaar Details

To update your Aadhaar card details please visit UIDAI portal

https://ssup.uidai.gov.in/web/guest/update