Mainly there are four ITR forms listed based on your category choose below appropriate ITR Form ITR Form for Salaried People If your income is from salary, pension, family pension and interest then you need to use ITR 1 Individuals and HUFs with income from any source other than business or profession then you need […]

Banking

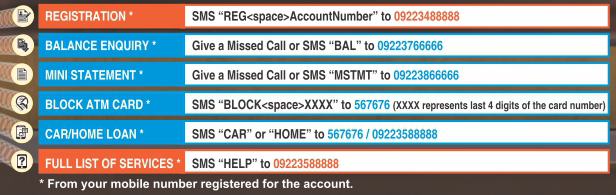

Dial 9223766666 to Get SBI Bank Balance Details

If you are a State Bank of India SBI customer, then you can get your bank account balance details, statement by just giving a missed call to the SBI Number. To get Balance details of your SBI State Bank of India, first you need to register by sending an sms as below: SMS to 9223766666 […]

Banks Fixed Deposit Interest Rates for 2016

Below are the Fixed deposit Interest Rates for 2016 of all Govt PSU Banks and Private Banks for 1 year, 2 years, 3 years. Bank Name 1 year 2 years 5 years State Bank of india 7.5 7.75 7.25 Union Bank of India 7.75 7.7 7.5 Citibank 7.25 7.5 6.75 IDBI Bank 7.75 7.5 7.5 […]

How Do I Make Sense of Retirement Savings Plans?

If you don’t have the retirement savings you want, one of the barriers you face is likely to be understanding all of the crazy, nonsense terms you think you need to understand just to open an account. There are really just four key words to understand in the retirement planning arena. That’s it. How Do […]

NEFT Timings and NEFT Transaction Fees

National Electronic Funds Transfer (NEFT) is a nation-wide payment system and if you would like to know NEFT Timings and NEFT Transaction Fees check below. NEFT Timings During Week Days, Monday to Friday NEFT Timings are from 8:00 AM to 7:00 PM. and on Saturday from 8:00 AM to 1:00 PM. NEFT Transaction Fees 1. […]

Mpesa Charges Fees When you Send Money to Bank

Using Mpesa wallet you can able to send money to Bank instantly via IMPS transaction and Mpesa charges certain fee based on the amount you send. The monthly amount you can send to either bank,mpesa customers, withdrawls or to other mobile numbers are only Rs 10000. To know the latest charges of Mpesa or new […]

Income Tax Slab for Year 2014-15

For the financial year 2014-15 the new income tax rules has been applied, individuals with below Rs 2,50,000 are under Tax payable. Check out Income Tax Slab for Year 2014-15, Section 80C has been increased to Rs 1,50,000 and also PPF Public Provident Fund saving also increased to Rs 1,50,000 from Rs 1,00,000. Income Range […]

How to Check Provident Fund Balance India

Before checking your Provident Balance, you should know your PF Number and Branch Name/Place, and follow below instructions on How to Check Provident Fund Balance india. 1. Go to this link http://epfoservices.in and follow the instructions over there, or. How to Check Provident Fund Balance 2. Go to this link http://www.epfindia.com/site_en/KYEPFB.php to directly check your […]