If you are a Paytm Payments bank customer and has lost or got stolen your Paytm ATM Card/Debit card then you need to block the card immediately from protecting fraudulent transactions. Check below how to block Paytm ATM card, Debit card charges and Paytm ATM card withdrawal limit.

Block Paytm ATM Card

There are two ways two block the lost ATM cum debit card, one is on Paytm App and by calling Paytm customer care.

Block Paytm ATM Card in App

Open the Paytm App on your mobile

Now click on the Bank icon at the bottom right

Enter your Paytm Payments Bank Passcode

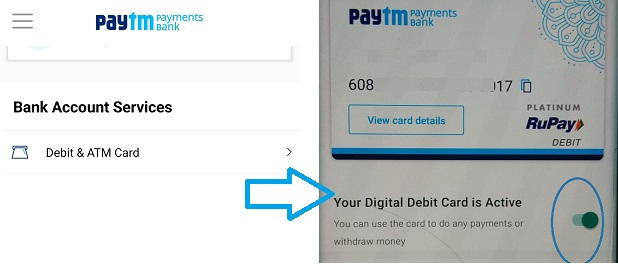

On bottom of the screen Under Bank Account Services Section -> Go to Debit and ATM Card Section

Now Uncheck the Green button, enter Passcode and your Paytm ATM card will be temporarily blocked instantly.

To Unblock your Paytm ATM Card

Just Enable the Green Check Mark and it will unblock the card.

Paytm Debit Card Charges

If you have the Paytm Physical card then it has some annual charges, check below for the Paytm ATM card charges.

For Digital RuPay Debit Card it is Free.

Annual Charges for Paytm card is Rs 100.

Charges are from the date of activation of the Paytm Debit & ATM card that is linked to your account.

For Lost Card Replacement Charges are Rs 125.

Paytm Cheque Book Charges:

For 10 Leaf book Rs 100

For 25 Leaf book Rs 150

Paytm ATM Card Withdrawal Limit

Using Paytm ATM/Debit card you can withdraw up to Rs 1,00,000 cash in a day in any ATM.

Paytm ATM Card Free Transactions:

In Metro Cities you can do 3 free ATM Cash withdrawal after that Rs 20 will be charged per transaction.

In Non metro areas 5 free ATM cash withdrawals is allowed after that Rs 20 will charged.

For Mini statement, Balance check, PIN change Rs 8 will be charged after free limit.